This post is sponsored by Lexington Law.

Adjusting from college life to professional life is not easy. Even though you’re on your own in school, and probably had an internship along the way; there is still a big transition into full blown adult mode. A transition that most colleges don’t really prepare us for. They offer small things along the way, but you don’t really know what to ask or who to ask because you’ve never experienced it, and that’s OK!

In order to make this transition easier, I’m going to go over 10 essential skills to help you get ready for real life. And l will give you some concrete suggestions on how to work on them right now! They are also broken into three buckets to make it a little easier: professional, life and financial literacy.

PROFESSIONAL

Professional Aptitude

Getting a job is one of the first steps to making it in the real world. But just throwing together a resume and randomly applying for jobs is not the way to go. If we don’t take this part seriously, we are more than likely going to be looking for something else in a few months and then for something else a few months after that. Having a professional aptitude means that you’ve taken the time to identify what type of job you want and then made a plan to get there. This should include:

- Setting up informational interviews

- Reaching out to your network (alumni, professional, personal) for open positions

- Performing organization/company research

- Updating your professional collateral (resume, cover letter, LinkedIn profile)

- Preparing for interviews

- Rehearsing salary negotiation scenarios

If you’ve already gotten a job, congrats! If you’re still in the process of looking for one, use the resources and people you have on hand. Check out your college career center as they usually offer services to alumni.

Interpersonal Skills

Organizational leaders cite interpersonal skills as one of the top things that recent college graduates are lacking. They don’t see our generation with the innate ability to interact with people in a face to face conversation. This is partially due to the rise of technology, schooling, and what we consider to be communication. With that said, it’s important to know how to carry on a conversation with colleagues, supervisors, and clients without the crutch of our devices. The good news is, this is something we can work on. To enhance your interpersonal skills:

- Practice active listening

- Talk to a mentor and ask for feedback

- Take a class (online or in person)

Prioritize

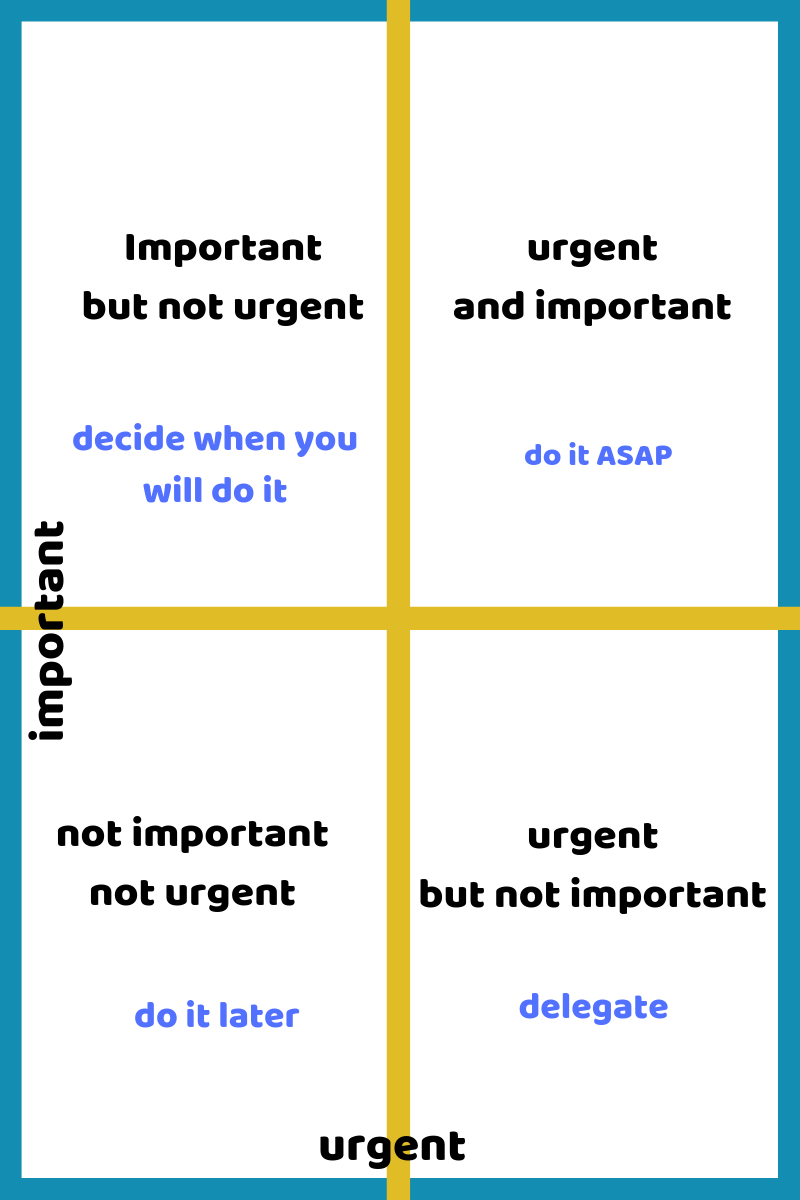

When you start a new job, so many things will be thrown at you at once and it’s important to be able to know what to do and when. Some of this comes down to time management (discussed below), but it also has to do with the ability to ask questions to understand the needs of your organization and to use your strengths to your advantage.

If you’re struggling to navigate this, try the Eisenhower Matrix and break down each item into its urgency and importance. From there, you can decide what needs to be done now and what can wait.

If you’re still unsure, talk with your supervisor about their priorities and urgency for tasks. You can even show them your grid and ask for suggestions.

LIFE

Resilience

Things do not always go as planned and it’s about what we do next that matters. Resilience is the ability to pick up the pieces and try again, in both your job and personal life. In school you might have experienced a set back with your grades and in the real world, it might be a poor performance review, or you missed out on your dream apartment. It’s about changing the narrative and one of the best ways to do this is through developing a growth mindset (term coined by Carol Dwek). Try using the phrases below to build your resilience:

- “Mistakes help me learn and grow”

- “This may take some time and effort”

- “I’m on the right track”

Time Management

One of the skills we were taught as kids was how to multi-task. While this can be great for some things, it often can lead to us mismanaging our time. And with technology and social media always being available, there are so many distractions. According to a post on Lexington Law’s blog, heavy Facebook users even have worse credit card debt and credit scores!

Instead of always multitasking (shifting from one task to the next), I batch like tasks together (checking email, updating spreadsheets). This helps my brain focus on one thing at one time and makes work more efficient. You don’t have to do this all day, every day but batching like tasks using the Pomodoro method can help better manage and keep track of your time. To do this, try one task for 25 minutes and then take a 3-5-minute break.

Relationship Navigation

The ability to start or end a relationship (personal or professional) with grace is something that will come up all the time. It’s not that easy to break up with someone when you’re in a serious relationship, remove a toxic friend from your life or start a new adult friendship. Being able to do these things with tact is a skill that will last a lifetime.

If this is new to you, try practicing in front of a mirror or role playing with another friend before jumping into the actual conversation.

“Adulting” Preparedness

The “adulting” scope covers so many life skills, but what I am talking about is the ability to live on your own. Some of these things include knowing how to:

- Do laundry

- Make meals

- Pay bills (we’ll cover that below)

- Schedule and go to doctor’s appointments

These broad skills will take some time to master but choose one and start working on it. If you’re finding yourself spending too much money on take out, work on one signature meal that you can have a few nights a week.

Patience

Regardless of where you are in life, patience is a skill that is needed. But in this “insta” world, it can be tough. Whether you’re looking to save money, pay off bills, or land a new job; things take time. When you find yourself getting antsy, remember why you started in the first place, breathe and keep chugging along.

FINANCIAL LITERACY

Money Management

In theory money management is “simple,” don’t spend more than you have. But in reality, there are so many things that pop in life where we have added expenses that we weren’t prepared for, jobs fall through, and things just happen. And according to a post on Lexington Law’s blog, a recent survey found almost 40% of millennials have spent money they didn’t have, going into debt just to “keep up” with their peers. Knowing where your money is (and isn’t) is one of the most important skills. To start a budget, try apps like:

- Mint

- YNAB

- Pocketguard

Related posts: Avoiding Budget Fatigue, Breaking the Cycle of Debt, Benefits of Having Good Credit

Credit Management

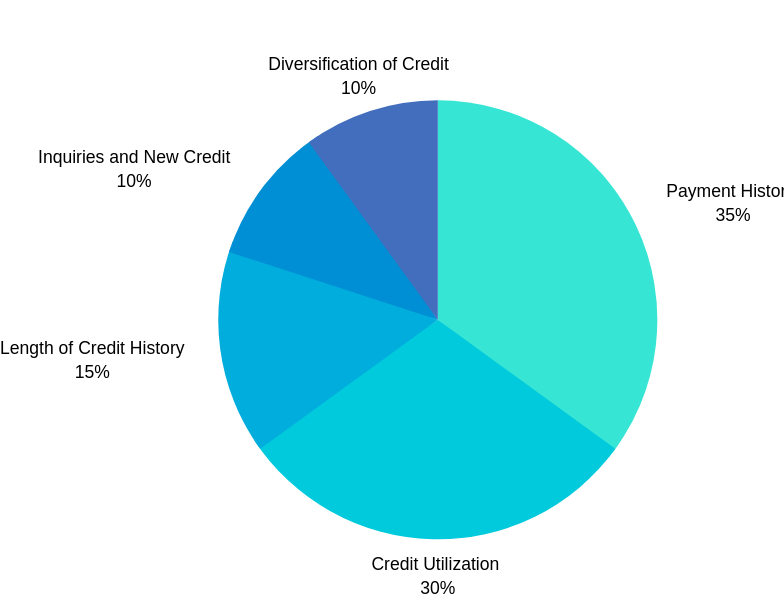

Above and beyond where and how you spend your money, you also want to understand your credit score and report. These two different things have a huge impact on your ability to rent an apartment, buy a car, and so many other “adulting” things you might not think about.

According to a post on Lexington Law’s blog:

Credit report: documentation of all the factors that are used to calculate your credit score but doesn’t include the actual three-digit “grade.” It lists every account you currently hold (including closed accounts and any accounts that have ever needed to be sent to a collection agency), all hard inquiries into your credit, and a list of your late and on-time payments

Credit score: a number between 300 and 850 that is used to grade your creditworthiness (aka: how good of a candidate you are for a loan). There are also five core factors that make up your credit score.

- Payment History (35%)

- Credit Utilization (30%)

- Length of Credit History (15%)

- Inquiries and New Credit (10%)

- Diversification of Credit (10%)

If you’ve never pulled a credit report, it’s important to do so and you can do it for free. From there you want to take time and look through it and also check to see if there are any inaccuracies. These inaccuracies can negatively impact your score and you want to work on getting them removed. If you’re unsure of what to do, it’s important to get support from professionals, like the ones at Lexington Law. The professionals will work with you to help you understand these inaccuracies and create a plan to remove them.

At the same time, look at your credit score. The higher your score is, the more likely you will be to get a loan and better rewards for credit cards. Here is the breakdown in scores:

- Exceptional: 800-850

- Good: 670-799

- Fair: 580-669

- Poor: 300-579

If you’ve been struggling to increase your credit score, it’s important to have the tools and resources. The professionals at Lexington Law work with their clients and pull a personalized credit score improvement analysis and to help you understand and repair your credit score.

- Cultivating Relationships - July 20, 2021

- Empowering Our People - July 13, 2021

- Finding Purpose - July 6, 2021